Residential REMAX real estate broker associate with expertise in luxury lake homes,lake homes,luxury homes, residential single family,condos, vacant land,foreclosures and investment properties. Serving the greater Milwaukee metro area including:Waukesha County, Lake Country, Jefferson,Dodge,Ozaukee Washington,Walworth,Milwaukee Counties. On-line markets, LISTING PACKAGE and FOR SALE by OWNER OPTIONS, MLS search access, buyer agency, Home Warranty, all with outstanding service!

Click here to search the MLS - wihomes4sale

Wednesday, May 26, 2010

5 Tips to Save Money for First-Time Home Buyers

Those who missed taking advantage of the first-time buyer tax credit but who are still planning the purchase of their first home, continue to have a wealth of opportunities in today’s marketplace. A few smart steps can save first-time buyers thousands of dollars. Here is a look at some of the ways how:

1. Don’t buy if you don’t plan to stay

If you can’t commit to remaining in one place for at least a few years, then owning is probably not for you, at least not yet. With the transaction costs of buying and selling a home, you may end up losing money if you sell any sooner – even in a rising market. When prices are falling, it’s an even worse proposition.

2. Start by shoring up your credit

Since you probably will need to get a mortgage to buy a house, you must make sure your credit history is as clean as possible. A few months before you start house hunting, get copies of your credit report. Make sure the facts are correct, and fix any problems you discover.

3. Choose carefully between points and rate

When picking a mortgage, you usually have the option of paying additional points- a portion of the interest that you pay at closing- in exchange for a lower interest rate. If you stay in the house for a long time- say three to five years or more- it’s usually a better deal to take the points. The lower interest rate will save you more in the long run.

4. Hire a home inspector

A home inspector can let you know if you’re about to buy a lemon of a house or warn you about potential problems. At best, you can move into the house confident that it’s in good shape; at worst, the inspector’s report can let you back out of the deal if the house has major, unexpected problems. Most typically, the home inspection can allow you to negotiate the home price to account for necessary repairs.

5. Get professional help

Even though the Internet gives buyers unprecedented access to home listings, most new buyers (and many more experienced ones) are better off using a professional agent. Look for an exclusive buyer agent,(LISA BEAR) if possible, who will have your interests at heart and can help you with strategies during the bidding process.

6. Bonus Tip: Be patient

Buying a home is one of the largest purchases most people will make in their lifetime. The key to avoiding buyer’s remorse is to be completely comfortable before signing on the dotted line.

Tuesday, May 25, 2010

"Money talks...but all mine ever says is goodbye!"

Money is one way of keeping score, isn't it! But the longer I'm in real estate, the more I value the joy and satisfactions of my customers. In fact, one of my greatest rewards is to look back on my many experiences as a RE/MAX sales associate. I love to re-live the enthusiasm of buyers and sellers when we find the right match!

One key to helping people discover their good fortune is to know who is thinking of selling and who is thinking about buying, as early as possible. That way I have more time to look for the 'one in a million' home. If you want to search for a home, or direct a friend to search, or to view recent home sales, please visit my website at lisabear.remax.com.

If you know of someone who's thinking of making a move, please give me a call. I pledge to work hard to deliver Premier Customer Satisfaction!

Lisa Bear

RE/MAX REALTY CENTER

(262) 893-5555

Monday, May 24, 2010

Mortgage Rates at NEW lows...now is the time to BUY

Mortgage Rates at New Lows, Thanks to Europe's Debt Crisis

Here's some good news for the struggling US housing market: Thanks to the European debt crisis, mortgage rates are at historic lows.

The current average rate for a 30 year fixed loan is 4.87 percent, according to Bankrate.com. That's the lowest rate for the 30 years since Bankrate started keeping track 25 years ago.

Even jumbo loan rates-loans for more than $417,000-have fallen. The 30-year fixed jumbo loan is at an average rate of 4.5 percent, down from nearly 6 percent at this time last year.

"It's the best time in our generation to buy," says Mark Zandi, chief economist at Moody's. "It may be the best time in any generation. Mortgage rates are so low and with homes prices down and lots of inventory, you couldn't pick a better time to buy or re-finance."

Europe's debt crisis is behind the drop. Nervous investors are flocking to the security of US Treasurys, which pushes down their yield and influences a host of consumer interest rates-including those on mortgages.

The decline is also good news for homeowners looking to refinance, particularly those who owe more on their mortgage than their house is worth.

"There's a tremendous window on re-financing," says Greg McBride, chief economist at Bankrate.com. "That's particularly true for people who can take advantage of the government's Home Affordability Refinance Program (HARP)-which allows home owners to refinance into low mortgage interest rates even if they're property value has gone down."

HARP, which was due to end at the end of this June, now runs through June of 2011.

"Think of the benefits if you buy or refinance now," says McBride. "Locking in now at the lower rates means more more bang for the buck and more breathing room for homeowners when it comes to payments."

But the decline in rates probably won't last long, analysts say. So homeowners need to move fast.

"I think they won't last much longer than a month or two at the best," says Lawrence Yun, chief economist at the National Association of Realtors. "I can see them going up to 5.5 percent by the end of June if not sooner."

The reasons? Yun says the worries over Europe will be fading soon and investors will be looking at other assets besides US Treasurys. And there's the US deficit, which will push up Treasury yields.

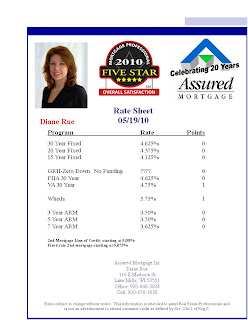

Todays mortgage interest rate just dropped further!

Todays Mortage Interest Rate

post is brought to you by:

CHARLIE JOHNSON from Ameristar Mortgage Corporation

PHONE LINES are now OPEN!!!

4.875 for purchase transactions just went to 4.625%

Amazingly low rates.

Charlie Johnson

2009-2010 FIVE-STAR Mortgage Professional Named Best in Client Satisfaction by "Milwaukee Magazine"

loanrngr@sbcglobal.net

You will want low interest rates and a smooth transaction. Charlie can deliver both.

cell 262-853-6256

work 262-782-7002 x2247

direct 262-439-2247

Saturday, May 22, 2010

So you wanna buy a foreclosure for dirt cheap?

Tips for Buying REO Properties in 2010

By RealtyTrac Staff

With the number of bank-owned REO properties expected to rise in the summer of 2010, here are 7 Tips that can help you snag a bank-owned property.

1.Hire an REO expert with experience buying bank-owned properties in your local market. (Lisa Bear)

2.Avoid lowball offers. Since most bank-owned properties are being sold at list price or above, a lowball offer will not work in most markets. Consider submitting an offer slightly above list price.

3.Determine the value of the property. You make your money when you buy, not when you sell. Lisa Bear can help you become an expert in your market so you can recognize a bargain instantly when you see it. Also have an inspector and contractor evaluate the property and itemize all the repairs that need to be made. Subtract the cost of these repairs from the estimated value.

4.Submit a complete package. Each lender has certain guidelines for submitting offers. Send a proof of funds letter, a bank account balance statement and a pre-qualification letter from your lender if you are using conventional financing.

5.Write multiple offers. Don’t expect your first REO offer to be accepted. Competition is fierce. Be prepared to write multiple offers on different properties before you land one.

6.Prepare for counteroffers. Banks will often send you a counteroffer at a higher price. You may be willing to raise your price slightly with the first counteroffer, but if a second counteroffer comes in, respond with your “best and final” offer.

7.Be prepared to walk away. If the bank doesn’t accept your offer or you’re unwilling to raise the price during the counteroffer period, be prepared to walk away and find another deal.

Learn more about how to buy bank-owned properties with Lisa Bear!!!

Wednesday, May 19, 2010

"An expert is a man who has made all the mistakes which can be made in a very narrow field." Niels Bohr

By that definition I am an expert. You see, my goal is to help my customers and clients avoid making a mistake in their home-buying efforts. In the process of guiding others, I have seen many fail to make the right decisions. For example, some people continue to rent long after they are able to buy a home.

A customer called the other day and asked if I could show a relative the difference between buying a home and renting. I am always pleased to discuss the financial benefits of home ownership. So encourage your friends and family to visit my website at lisabear.remax.com. Visitors can view homes for sale, use mortgage calculators, and even search for homes based on personal criteria. Request a showing appointment when you're ready. It's all there!

Using the remax.com computerized real estate system, I can find the right home, compare financing options, or review the benefits of ownership in just a few moments. If the right home is "out there" we'll find it! And, in the end, if renting is the best option, I can make a referral to a rental "expert."

So if you have a friend who's curious about a home, or sees an ad on a property and wants some more information, please call me. I'll help your friends do the right thing.

Lisa Bear

Interest Rates --- EXPLAINED

What is an interest rate?

1) By definition: An interest rate is a formula used to calculate the profit for money borrowed. It is typically expressed as a percentage.

2) In practice: Interest rates are used as a form of advertising by a lender for generating business.

#1 is pretty easy to understand, so....

Let's focus on #2:

Banks and mortgage companies are in the business of creating home loans.

They generate personal and commercial profits by doing so. Their "product" is money...and their profit is generated by lending it. The best way for them to attract a consumer is to advertise the rate that will be paid once the loan is made. Sounds pretty cut and dry, doesn't it? But...it's not.

It is one of the most misunderstood and abused aspects of the mortgage industry. Until we recognize it for what it is....know when something is "the real deal"...and stop buying into the "bait and switch".

We must understand that not one interest rate fits all buyers or home purchase.

We must learn that under no circumstance will a bank or a mortgage company offer an interest rate well below "the street" out of the goodness of their heart.

These lenders will regain their profit in another part of the transaction....and that could be by overcharging closing costs, failing to disclose origination fees or by selling the consumer other bank related services (checking accounts, insurance, credit cards, etc.)

Yet...not advertise that these are the terms of the rate they offer or accept application for. These things do happen everyday!!!

Tuesday, May 18, 2010

Did you forget to do something today?

So funny this...

I was showing a home in Oconomowoc yesterday afternoon. When I arrived there was a couple hanging out by the house. While I waited for my buyers, the couple came came up to me an asked if I was an agent. They asked me to show them the home...cuz their realtor FORGOT to show up. They were from out ...of town.

Needless to say --- I have a new buyer and we are looking at a bunch Thursday morning!

Monday, May 17, 2010

My KIND of DIET! The CHOCOLATE milk diet!!!

Imagine if everything you needed to know about weight loss, you learned in kindergarten. Well, if your teacher gave you chocolate milk as a lunchtime treat, she was (unknowingly) giving you one of the most powerful weight-loss tools in the nutritional universe. Turns out this childhood staple may be the ideal vehicle for your body’s most neglected nutritional needs. Each bottle delivers a package of micro- and macronutrients that can help you shake off body flab and replace it with firm muscle. And when you served it ice-cold, the creamy sweetness flows across your tongue with all the pleasure of a milk shake. Yum.

That’s the crux of what I'm calling "The Chocolate Milk Diet," which isn’t a diet at all. It’s essentially three eight-ounce servings of chocolate milk consumed at key points throughout your day: one when you wake up, a second before you exercise, and a third directly after your workout. Or, if it's your day off, just pattern them for morning, afternoon, and night. Sounds good, right? It is, and that’s why it’s so easy. But is this a free ticket to eat as much fried chicken as you want throughout the rest of the day? Unfortunately not, but alongside a healthy diet, it can help you drop lots of belly fat fast. Here are the four reasons why:

Secret #1: The Calcium Effect

Researchers have known for years about the role that calcium plays in building strong bones, but a more recent development deals with they way it affects your belly. A series of studies have shown that calcium can actually impede your body’s ability to absorb fat, and when researchers in Nebraska analyzed five of these studies, they were able to estimate that consuming 1,000 mg more calcium can translate to losing nearly 18 pounds of flab. What’s more, other studies have shown that dairy foods offer the most readily absorbable calcium you can find. Knock back three servings of brown cow and you’ll reach that crucial 1,000 mg threshold. At that point, any other calcium that you eat or drink is a bonus.

Secret #2: The Vitamin D Factor

All the calcium in the world isn’t going to help you if you don’t get a good dose of vitamin D to go with it. That’s because vitamin D is responsible for moving calcium from your food to your body, which means if you’re running low on D, you’re probably also missing the calcium you need to stay slim. Other symptoms of the D deficiency are weak muscles, easily breakable bones, and depression—not a great combo for success. Now here’s why this is significant: Most experts agree that the average American isn’t getting enough D. Some estimate that only half the population is meeting the requirement and one study published in the journal Pediatrics found that 70 percent of American children had low levels of D in their diet. The thing is, your body makes vitamin D naturally when you expose your skin to sunlight, but most people spend too much time indoors to benefit. And intentionally spending more time in the sun could put you at risk for skin cancer. The solution? Drink up. Chocolate milk, like most milk, is fortified with vitamin D.

One caveat here: Drink 1% chocolate milk. Vitamin D won't work without a little fat to help break it down. You want to skip the whole milk, too, as it has too many calories to make it a regular habit. The best option is 1%, or low-fat chocolate milk. It has the fat you need to absorb crucial vitamins, yet at three cups a day, it will save you 120 calories over whole milk.

Secret #3: The Endurance Boost

If you want to lose the gut, you’ve got to exercise—no surprise there. But here’s a fact that’s not so obvious: Drinking chocolate milk can improve your gains. In a study published in The International Journal of Sport Nutrition and Exercise Metabolism, subjects given chocolate milk before hopping on the stationary bikes were able to ride 49 percent longer than subjects given a generic carbohydrate-replacement beverage. And on top of that, they pedaled even harder. Total work performed by the chocolate-milk group was greater than the work performed by subjects drinking carbohydrate-replacement drinks or electrolyte-fortified sports drinks. The reason? Milk has naturally occurring electrolytes that keep you hydrated—more hydrated then water, in fact, which I revealed recently on my Twitter account—and its natural sweetness helps push more energy into your muscles. Another study from 2009 found similar results, but it went one step further by asking participants which beverage they thought tasted better. Not surprisingly, 100% chose chocolate milk.

Secret #4: The Protein-Body-Weight Connection

Want to know the secret to staying thin? You need more muscle. That’s because muscle burns more calories than fat, so for every new muscle fiber you create, your resting metabolism receives another surge of fat-torching energy. And chocolate milk can help you do that. Researchers have determined that the ideal protein load for building muscle is 10 to 20 grams, half before and half after your workout. How much protein will you find in low-fat chocolate milk? Eight grams per cup. (That means one serving before your workout and one serving after will give you a total of 16 grams of highly effective whey protein—a perfect serving.) Add that to the extra cup you drank first thing in the morning and you’re looking at a turbocharged metabolism that keeps you burning calories all day long.

And don’t forget, you can still melt those 18 pounds of belly fat without giving up your favorite foods. You just need to make smart swaps!

Like this story or have another nutrition secret? Please share it with others here.

Sunday, May 16, 2010

A Pat on the back

Hi Lisa:

I am in the midst of moving and cleaning (such fun stuff) but before I forget, I wish to tell you how much I enjoyed working with you on purchasing my new house. You did an excellent job from start to finish and I appreciate that.

I hope you have great success in the future and wish you all the best. This is still a challenging time for all businesses and the Real Estate Market is no exception. I had a few minutes yesterday to drive by some of the homes we looked at and they are still for sale. I suspect that prices in the Real Estate market are still in a state of flux and will be for a while.

I will spend some time looking a your new website when I have completed moving. It looks good. I would surely make sure you stress your expertise as a Realtor and time in the business. There is no substitute for knowledge and experience and you have both.

People expect to have excellent service and instant response these days because of cell phones, email and the internet (It sometimes amazes me what my customers expect the time frames to be!). Talk about that on your website ...... you truly can deliver it!!!

Thank you for all your help.

Michael

Friday, May 14, 2010

Have a few million to spare? Field of Dreams for sale!!!

Real estate agents can often get hyperbolic when talking about a "one-of-a-kind" property, but I don't think anyone will dispute that label on the newest listing in Dyersville, Iowa.

After all, how many iconic movie sets are not only available for purchase, but can also be lived in? The 193-acre farm where Kevin Costner and James Earl Jones filmed 1989's "Field Of Dreams" has been listed for sale by its owners after over a century of family ownership and the Des Moines Register reports that the asking price for the whole lot is $5.4 million.

That'd make for a good-sized mortgage, but it'd also get you the big farmhouse, the baseball diamond that Universal cut out of the corn, a few more farm buildings and about 65,000 tourists a year willing to buy your T-shirts and postcards.

Additional features include a vague yet suggestive voice in the sky, members of the 1919 Black Sox periodically showing up for a night game and the opportunity to play catch with your father's ghost.

It basically sounds like a great opportunity for anyone, so long as your brother-in-law isn't the dream-crushing character played by Timothy Busfield.

Former major league pitcher Ken Sanders is helping Don and Becky Lansing oversee the sale as they head into retirement and he says he's not quite sure who will end up as the buyer:

"It would be easy to guess a baseball player, a movie buff or even someone from the film's cast," Sanders said.

"But the movie's reach has been so widespread, potential buyers don't necessarily fall within those demographics. It could end up being a non-profit organization, a land trust or a foreign investor. We might all be surprised."

I know everyone's been joking all day about placing a bid on the house, but I'm completely serious in trying to convince my bosses to make this the new blogging headquarters of Big League Stew. Considering I could spend my lunch hour taking some hacks before eating at the unparalleled Country Junction restaurant nearby, it's a chance of a lifetime.

Head on over to SellFieldofDreamsMovieSite.com if you want to see all the real particulars (square footage, barn amenities, etc.) and put an offer together before I do. Or you can just listen to Terence Mann's "people will come" speech for much cheaper soul nourishment.

Thursday, May 13, 2010

Create your own MONEY TREE - Mortgage advice

"Shoot for the moon. Even if you miss, you'll land among the stars." Les Brown

That's good advice for space travel. And it could encourage an actor to continue their rehearsals until they make it to Carnegie Hall. However it's not a proven strategy for buying real estate.

As a homebuyer your question might be: "How will I know how much to offer?"

Who will help you decide? Does a home seller or their listing agent worry about you getting a good deal on your purchase? "NO!" The seller and the seller's agent are concerned primarily about their interests, not yours.

My customers have benefited from my attending to their concerns. You can, too. When we work together I will work to make sure you find the right home for your needs and wants. And then we'll work to get the most acceptable pricing and financing package, too.

I encourage you to visit my website at lisabear.remax.com where you can become familiar with homes for sale, home sales prices, and the most important market and neighborhood information. You can even begin your search for your new home with the dream home finder. See something you like? You can schedule a showing. Now is the time to visit.

Don't risk driving by the home of your dreams. Call upon me to find your home for you.

Lisa Bear

RE/MAX REALTY CENTER

(262) 893-5555

Lake Living at its Finest -- Home for Sale in Waukesha County with frontage on two lakes!

Fantastic lake frontage on both Lower Nashotah & Upper Nemahbin Lake for sale (2.5-2.8 million)

Custom built featuring top of the line quality. Gourmet Kitchen, granite counters thru-out, massive pantry, birch woodwork,maple floors, sunroom, 4BR's include 2 master suites. LL rec rm w/wet bar, media center, GFP, game & exercise area and wine cellar. 2.5 car GA + 5 car detached GA, boathouse w/deck

Frontage - 250 feet of frontage on the Nashotah side and about 60 on the Nemahbin side.

Contact me for further information and a private showing!

Subscribe to:

Posts (Atom)