Residential REMAX real estate broker associate with expertise in luxury lake homes,lake homes,luxury homes, residential single family,condos, vacant land,foreclosures and investment properties. Serving the greater Milwaukee metro area including:Waukesha County, Lake Country, Jefferson,Dodge,Ozaukee Washington,Walworth,Milwaukee Counties. On-line markets, LISTING PACKAGE and FOR SALE by OWNER OPTIONS, MLS search access, buyer agency, Home Warranty, all with outstanding service!

Click here to search the MLS - wihomes4sale

Saturday, January 31, 2015

Why List with me?

We are every where ---- meaning our marketing for sellers reaches far beyond just locally or Wisconsin! RE/MAX Realty Center - Real Estate in Wisconsin is your best source for home selling!

Friday, January 30, 2015

How are first-time homebuyers becoming more diverse?

How are first-time homebuyers becoming more diverse?

Median Age of First-Time Buyers:

Racial and Ethnic Distribution of First-Time Buyers:

Country of Birth of First-Time Buyers:

Primary Language Spoken by First-Time Buyers:

The Future of First-Time Buyers:

For more information on this research, check out the:

2014 Profile of Home Buyers and Sellers and William Frey’s book Diversity Explosion

How are first-time homebuyers becoming more diverse?

Posted in Economist Commentaries, by Brandi Snowden, Research Survey Analyst on January 21, 2015Share on facebookShare on twitterShare on linkedinShare on google_plusone_shareShare on emailMore Sharing Services766

- Using data from NAR’s 2006-2014 Profile of Home Buyers and Sellers, we

can examine how the demographics of first-time homebuyers have changed

over the last 9 years. What do these numbers show us about the diversity

of buyers, and what insight can they provide for the future? - The demographic characteristics of first-time buyers overall has

remained consistent over the last 9 years with slight increases and

decreases.

- Since 2006 the distribution of first-time buyers’ household

composition has remained predominantly married couples, making up an

average of 52% of first-time buyers. - On average 22% of first-time buyers were single females and 12% were single males or unmarried couples.

Median Age of First-Time Buyers:

- The median age of first-time buyers has remained within a 3 year age gap between 30-32 years old.

- The average median age of first-time buyers since 2006 was 31 years old.

Racial and Ethnic Distribution of First-Time Buyers:

- The racial and ethnic distribution of first-time buyers has remained

predominately White/Caucasian, making up an average of 77% of

first-time buyers since 2006. - The averages of other races and ethnicities are:

- Black/African American: 8%

- Hispanic/Latino: 8%

- Asian/Pacific Islander: 7%

- Other: 3%

Country of Birth of First-Time Buyers:

- Since 2006 the number of first-time buyers who were born in the U.S.

has increased and then decreased settling back to 86% in 2014, the same

as in 2006. - On average 87% of first-time buyers were born in the U.S. and 13% were born outside of the U.S.

Primary Language Spoken by First-Time Buyers:

- Over the last 9 years, English has remained the primary language of first-time buyers.

- On average 7% of first-time buyers spoke other languages, while 93% spoke primarily English.

The Future of First-Time Buyers:

- While the demographics of first-time buyers over the last 9 years

have not necessarily seen great changes, there is still the outlook for

the future. - William Frey, of the Brookings Institution, recently published the

book “Diversity Explosion” which looks at the demographic future of

America. - Frey expounds that America is becoming a country with no racial

majority, with a dramatic growth of young minority populations expected.

- Frey predicts that sometime after 2040 there will be no racial

majority; this would ultimately change the demographics of the

first-time homebuyers moving towards greater diversity.

For more information on this research, check out the:

2014 Profile of Home Buyers and Sellers and William Frey’s book Diversity Explosion

Thursday, January 29, 2015

Buying a Newly Constructed Condo?

Buying a Newly Constructed Condo?

By: Selene Garcia

In an effort to provide easy to understand educational mortgage topics, Guaranteed Rate offers condo mortgage rules for buying newly constructed condos. There are many condo building features your lender will be concerned with whether you’re purchasing a unit in a new or established condo building.

When purchasing a condo unit, lenders want to ensure the entire condo project (the building) is warrantable. Warrantability refers to the favorable, or unfavorable, features of a condo building and whether or not a lender is willing to offer mortgages to buyers based on those particular features.

While there are some lenders that offer financing for non-warrantable condos, available rates and programs are not as competitive and typically require a higher down payment. Speak with your mortgage professional to learn more about purchasing non-warrantable condo units.

Warrantability for an established condo building focuses on pending lawsuits, non-owner rental units, blanket mortgage clauses and the association’s savings; however, there are additional requirements for newly established, or rehabilitated, condominium projects.

There are two ways a new condo project can be approved as warrantable:

Project Eligibility Review Service (PERS)

A PERS approval allows a developer to have the entire condo project approved by Fannie Mae prior to the completion of the project. This type of approval allows buyers to obtain competitive financing due to more flexible condo requirements.

For more details, speak with your seasoned mortgage professional about Fannie Mae PERS reviews.

Pre-Sale Requirements

If the development you’ve chosen has not been approved by Fannie Mae through a PERS approval then the building of your choice will need to meet the following requirements:

70 Percent Owner Occupancy. The lender requires 70 percent of the units sold, or under contract, are either occupied by an owner or used as a second home. For the lender, high owner occupancy in a new building translates into a safer investment (i.e., owners have a vested interest in the care and maintenance of the building).

Complete Construction. Lenders require the completion of allcommon elements such as: hallways, lobby, laundry and exercise facilities prior to any sale. From the lender’s perspective, if the developer runs into financial challenges, an incomplete building can negatively impact the value of their collateral.

Additional Phases. The lender wants to ensure the building is not subject to additional construction (i.e. additional towers or floors which need to be completed). Again the concern here is the lender’s investment – at minimum the project should be completed.

Condo Association. In a new project, the developer will hand over control of the association to the building owners when about 75 percent of the units have been sold.

To be clear, your lender is looking for all of these questions to be answered with a yes. If no is the answer to any of these questions, the project is non-warrantable and you’ll need to adjust your financing expectations.

With regard to warrantability, Fannie Mae will sometimes make exceptions for an already established condo building; however, with newly constructed condo buildings Fannie is very clear about the requirements.

When in the market for a condo, be sure and let your mortgage professional know what type of building you prefer – new construction or an already established condo building.

Wednesday, January 28, 2015

5 Demands to Make on Your Listing Agent

5 Demands to Make on Your Listing Agent

Are you thinking of selling your house? Are you dreading having to

deal with strangers walking through the house? Are you concerned about

getting the paperwork correct? Hiring a professional real estate agent

can take away most of the challenges of selling. A great agent is always

worth more than the commission they charge just like a great doctor or

great accountant.

Are you thinking of selling your house? Are you dreading having to

deal with strangers walking through the house? Are you concerned about

getting the paperwork correct? Hiring a professional real estate agent

can take away most of the challenges of selling. A great agent is always

worth more than the commission they charge just like a great doctor or

great accountant.You want to deal with one of the best agents in your marketplace. To do this, you must be able to distinguish the average agent from the great one.

Here are the top 5 demands to make of your Real Estate Agent when selling your house:

1. Tell the truth about the price

Too many agents just take the listing at any price and then try to the ‘work the seller’ for a price correction later. Demand that the agent prove to you that they have a belief in the price they are suggesting. Make them show you their plan to sell the house at that price – TWICE! Every house in today’s market must be sold two times – first to a buyer and then to the bank.The second sale may be more difficult than the first. The residential appraisal process has gotten tougher. Surveys show that there was a challenge with the appraisal on almost 20% of all residential real estate transactions. It has become more difficult to get the banks to agree on the contract price. A red flag should be raised if your agent is not discussing this with you at the time of the listing.

2. Understand the timetable with which your family is dealing

You will be moving your family to a new home. Whether the move revolves around the start of a new school year or the start of a new job, you will be trying to put the move to a plan.This can be very emotionally draining. Demand from your agent an appreciation for the timetables you are setting. Your agent cannot pick the exact date of your move, but they should exert any influence they can, to make it work.

3. Remove as many of the challenges as possible

It is imperative that your agent knows how to handle the challenges that will arise. An agent’s ability to negotiate is critical in this market.Remember: If you have an agent who was weak negotiating with you on the parts of the listing contract that were most important to them and their family (commission, length, etc.), don’t expect them to turn into a super hero when they are negotiating for you and your family with the buyer.

4. Help with the relocation

If you haven’t yet picked your new home, make sure the agent is capable and willing to help you. The coordination of the move is crucial. You don’t want to be without a roof over your head the night of the closing. Likewise, you don’t want to end up paying two housing expenses (whether it is rent or mortgage). You should, in most cases, be able to close on your current home and immediately move into your new residence.5. Get the house SOLD!

There is a reason you are putting yourself and your family through the process of moving.You are moving on with your life in some way. The reason is important or you wouldn’t be dealing with the headaches and challenges that come along with selling. Do not allow your agent to forget these motivations. Constantly remind them that selling the house is why you hired them. Make sure that they don’t worry about your feelings more than they worry about your family. If they discover something needs to be done to attain your goal (i.e. price correction, repair, removing clutter), insist they have the courage to inform you.

Good agents know how to deliver good news. Great agents know how to deliver tough news. In today’s market, YOU NEED A GREAT AGENT!

Tuesday, January 27, 2015

Monday, January 26, 2015

Bigger Isn’t Always Better

Bigger Isn’t Always Better

Everyone’s drawn to the biggest, most beautiful house on the block. But bigger is usually not better when it comes to houses. There’s an old adage in real estate that says don’t buy the biggest, best house on the block.

The largest house only appeals to a very small audience and you never want to limit potential buyers when you go to re-sell. Your home is only going to go up in value as much as the other houses around you. If you pay $500,000 for a home and your neighbors pay $250,000 to $300,000, your appreciation is going to be limited.

Sometimes it is best to is buy the worst house on the

block, because the worst house per square foot always trades for more

than the biggest house.

Everyone’s drawn to the biggest, most beautiful house on the block. But bigger is usually not better when it comes to houses. There’s an old adage in real estate that says don’t buy the biggest, best house on the block.

The largest house only appeals to a very small audience and you never want to limit potential buyers when you go to re-sell. Your home is only going to go up in value as much as the other houses around you. If you pay $500,000 for a home and your neighbors pay $250,000 to $300,000, your appreciation is going to be limited.

Nice alternative to FHA.

Nice alternative to FHA.

Fannie Mae 97% LTV)

New

Update - LTV ratio limits have been expanded up

to 97% for Fannie Mae loan transactions. This includes fixed rate terms

of up to 30 years, no income limits,

and standard 35% MI Coverage. Purchase transactions require at least

one buyer to be a First Time Homebuyer.

For more information -- contact me or Charlie Johnson!

Sunday, January 25, 2015

Friday, January 23, 2015

10 Interior Design Trends That Turn Off Home Buyers

10 Interior Design Trends That Turn Off Home Buyers

You want your home to look its best, and maybe you've been inspired by the interior design trends you've seen in magazines, on TV or on design websites.But following some of the hottest home remodeling and interior design trends can backfire when it comes time to sell your home.

Buyers want to picture themselves in a home, and highly individualistic touches can get in the way of that.

When you're ready to sell your home, it's best to put things in pristine, move-in condition and remove all of the individual touches that made your house a home.

After all, your goal is to get potential buyers to picture themselves in the home--and they won't be able to do that if your decorating style still dominates.

Check out the caveats that go along with these home interior design trends.

1. Boldly Painted Walls

Decorators often tout black or another bold paint color as the perfect backdrop to metallic accessories or appliances in modern home design. The reality is that people prefer the exterior and interior walls of a home to be neutral. Even though repainting is cheap and relatively easy to do, it's still a pain and buyers might not want to bother. When decorating, your best bet is to stick to an appeasing hue for the walls and use accessories to provide pops of color.2. Wallpaper

Bold, graphic patterns increasingly are being incorporated into interior design, often in the form of wallpaper. But wallpaper--even if it's only on one wall--is an extremely personal choice and time-consuming to remove if it doesn't appeal to the buyer. Consider replacing wallpaper with a neutral paint for broader appeal.3. Lavish Light Fixtures

While potential buyers want rooms that seem airy and bright, beware of installing a showpiece light fixture that is too modern or ornate. Fixtures should enhance your home--not steal the spotlight.4. Gleaming Gold

Designers may be mixing silver and gold to give homes star quality, but it might be wise to change out fixtures if they have the wrong metallic sheen.Gold can give a home an outdated, '80s feel. Switching out the faucet and door handles with a more appealing finish--such as brushed nickel--is relatively inexpensive and can help make your home appear sleek rather than out of style.5. Converted Garages

People want a covered parking space so that they have a safe place for their car--especially in areas where street parking is at a premium. Additionally, people often use their garage as storage space.If you convert your garage into a space tailored your specific needs, such as a music practice room, it may not suit your potential buyers.6. Converted Bedrooms

Like with the garage, people want rooms built for their original purpose.If you've converted an unused bedroom to an office, walk-in closet, or a game room, make sure you can easily convert it back to a bedroom when you're ready to sell.7. Carpets

While designers love to play with the texture of shag carpeting as it feels soft underfoot, the majority of home buyers prefer hardwood floors. People assume carpets trap dirt, germs and odors, and they don't want to go through the hassle of steam cleaning their home before they can move in. Potential buyers also don't want to spend time removing carpet to expose hardwood floors.If someone really loves carpet, it's much easier for them to add it themselves--after the purchase.8. Too-Lush Landscaping

The "outdoor living room" is all the rage, and you may be tempted to build out your backyard into a lavish wilderness of flowers. But potential buyers may be hesitant to buy a home with an overly landscaped property requiring a lot of maintenance. Focus on creating or maintaining a nice and neat outdoor space that people can enjoy without too much fuss.9. Pools and Hot Tubs

A pool may seem like a luxurious feature, but it can be a big turnoff for buyers. Pools are perceived to be expensive to maintain and potential safety hazards, especially for families with children. Above-ground pools are eyesores and can leave a dead spot in the backyard.These sentiments extend to hot tubs, too. Many people see hot tubs as breeding grounds for bacteria, and they are not a feature easily removed from the deck or back yard.10. Fancy (or Not) Pet Products

Sales of pet products are expected to increase nearly $3 billion from last year, and there's an increasing market for luxury pet items. But even animal lovers don't want to see another family's pet paraphernalia in a potential home. Even if your home is immaculate, the presence of pet-related items will give the impression that it's dirty.Lisa Bear of RE/MAX (262-893-5555), your real estate expert offering online markets, listing package and FOR SALE BY OWNER (FSBO) options, MLS search access, buyer agency and marketing that will exceed your expectations, all with outstanding service! Your home purchase or sale is likely your largest investment, be sure you have an good agent you can trust!

Real Estate in Wisconsin is an excellent investment, prices are superb, selection is great and rates are outstanding!!!

Who knew?

11 Very Strange – But True Wisconsin State Laws

We’ve all heard that “justice is blind.” But sometimes – it can also be pretty ridiculous. Wisconsin laws are no exception.

The most mysterious thing about strange laws like these, is that there had to be a reason why they were put into place once upon a time.

After reading these 11 Wisconsin state laws, you’ll probably find your imagination running a little wild. But at the very least, I hope we get a laugh outta ya.

We know some silly state laws are just legend. But as far as we know, the following laws are real statutes that came straight from the Wisconsin State Legislature. I even called and talked to a librarian at the Wisconsin State Law Library to ask for help confirming these laws.

I took out the ones she told me were nonsense right off the bat, but she never got back to me about the rest of the list.

Maybe they just didn’t have a sense of humor about it…

So if you think any of these Wisconsin laws are false – let us know in the comments.

1. It’s Illegal to Serve Margarine in Wisconsin

From 1925-1967 margarine was banned from sale in the state of Wisconsin. I guess Wisconsinites even tried smuggling it in, or making what they called “oleo runs” from Illinois. Thousands of Wisconsinites became fake-butter law breaking felons.

You criminals!

No joke. Wisconsin statute 98.17 has been in place since 1895 and it still stands today. It’s still illegal for restaurants to serve margarine – unless the customer specifically orders it. The “yellow stick from Satan himself,” as Governor Warren Knowles called it – is also a big no no in prisons, hospitals, schools or other state institutions – unless absolutely necessary for health reasons.

2. It’s Illegal Not to Give Livestock the Right-of-Way

One of WhooNEW’s Facebook fans made sure to point out that this law is not a dumb one. That it must have been a “cidiot” who put that on the list.

Well, the law might not be silly. But the people who decided to plow their vehicle straight through the poor roaming livestock sure are.

And Wisconsin statute 346.21 says we must give the farm animals the right of way on Wisconsin roads and highways.

So MOOve over for ‘em would ya?

That’s really sweet though, Wisconsin. To give these poor animals legal protection from crazy drivers since 1957. Especially because they don’t even have too long before we gut them and eat them for dinner.

3. When Two Trains Meet, Neither Should Proceed Until the Other One Has

Did you read that twice? I had to…

I’m not really sure what would truly happen if a couple of railroad engineers actually decided to obey this one. It’s really quite hilarious when you think about it!

I bet it made for some delays on the railway.

Now…what about livestock on railroad tracks in Wisconsin? They do call those things on the front “cowcatchers” after all.

4. Businesses May Only Base Their Hours on Central Time

Here’s a good reason not to forget about Daylight Saving Time…

If you own a business in Wisconsin, your store hours better be advertised in the Central Time zone, or you could be fined $25-$500 and jailed for 10-30 days – according to Wisconsin statute 175.09. How could you confuse us like that?

Just think… there’s a valid reason behind every law…

5. It’s a Crime to Harass a Seeing-Eye-Dog in Wisconsin

What sort of bully would do such a thing? I can’t help but wonder the details behind this strange law.

You’d have to be a real jerk to mess with a dog helping a disabled person or leading a blind person. But I suppose there are plenty of jerks out there.

6. Wisconsin Cheese Must Be “Highly Pleasing”

I’m not kidding, if you look up Wisconsin’s cheese laws – and there are a lot of them – you’ll see.

The law states that the cheese must be “highly pleasing.” (Source)

I don’t think my husband ever ate a piece of cheese he didn’t find highly pleasing.

There are plenty more cheesy laws where that came from. Like, you have to have a master cheese-making license to make Limburger cheese. And, it’s illegal to make baby Swiss cheese without well-developed eyes.

But I must burst your bubble and tell you that the crazy law about having to serve a piece of cheese with a slice of apple pie is only a legend.

7. Adultery – Class I Felony

Turns out your cheating heart can land you in prison if you are unfaithful in Wisconsin.

That’s right, supposedly anyone who’s caught cheating on his or her spouse can be fined $10,000 and get up to 3 years in prison, thanks to Statute 944.16.

Did you know this law was put into place in 1849, one year after Wisconsin became a state?

When I asked the Wisconsin State Law librarian about this one, she said “If you put that in there, you’re really going to freak some people out.” Haha.

Well… isn’t that a good thing!? Maybe some of these outdated laws have some merit after all.

8. You Can’t Force Someone to Have a Microchip Implanted

Have you heard NBC’s prediction that all Americans will be forced to get an RFID microchip implanted in them by 2017 per ObamaCare?

Well, guess what ObamaCare? That’s illegal in Wisconsin! Yep, we’re one of 5 states that passed legislation on mandatory microchip implantation. Woohaha. Doesn’t it feel good to be a Wisconsinite.

- Read The Truth Behind the ObamaCare Microchip Implant Rumor from obamacarefacts.com

9. It’s Illegal to Shoot Animals From an Airplane

Are we talking about birds here? I mean COME ON. Who in their right mind would go shooting at grounded animals anyway? Wouldn’t you be deathly afraid of accidentally taking out a few humans?

OMG.

Although, it would certainly be an interesting twist when deer hunting season rolls around.

10. It’s Illegal to Blow Up a Muskrat House

You would literally have to go out of your way to break a law like this. Who on Earth put the Wisconsin State Legislature through the hassle of having to pass this law? Don’t you have better things to do?

And what about beaver dams? Can I legally stick some dynamite in a prairie dog hole?

Anyway – if you happen to be a muskrat – this is a great law.

11. It’s Illegal to Sell Colored Chicks, Ducklings or Rabbits

This must have been someone’s idea for a great way to celebrate Easter? Why else would someone dye these baby animals and sell them? Well folks – in Wisconsin – I guess we’re going to have to stick to decorating eggs.

Apparently, the rights of “unborn chicks” are still unprotected.

But speaking of chicks and ducklings – you may have heard that it’s against the law for our neighbors in Minnesota to cross the border into Wisconsin with a duck or chicken on their heads. Seems logical, right?

Turns out this one is another legend that was probably confused because of an old law dealing with a fabric called duck cloth. Read more from Minnesota Public Radio.

However, if you do catch a Minnesotan crossing state lines with any sort of feathered friend on their head – I don’t care if it’s a goose, a pigeon or a peacock – your civic duty as a Wisconsinite is to send them back where they came from.

Other Funny City Laws in Wisconsin

Sheboygan – It’s illegal to water your lawn in a way that annoys others.Did you hear that grumpy old man next door who never turns his sprinkler off? You’re lucky this is Green Bay!

Racine – It’s illegal to wake a fireman when he is asleep.

But…but…what if there is a FIRE!?!

Racine – It’s illegal to shoot missiles at parade participants.

How about launching grenades? That’s cool, right?

Connorsville – It’s illegal to fire your gun while your female partner is having an orgasm.

Not sure if you’d do that to cover up her noisy moans of pleasure, or to celebrate finally finding the G-spot.

La Crosse – It’s illegal to worry a squirrel.

Squirrels are such worry-worts already. It drives me nuts!

La Crosse – It’s illegal to play Checkers in public, because it’s also illegal to say “king me.”

So then, if I were playing Checkers with a squirrel in a La Crosse public park, and he was worried I might win then…ah never mind.

Kenosha – It’s illegal for men to be in the state of arousal in public.

I don’t know if there is a police officer in Kenosha who has to check all the men’s pants. If there is – I hope he gets paid well.

Milwaukee – If you’re thought of as offensive looking, it’s illegal for you to be out in public during the day.

Ok, that’s just plain mean, Milwaukee.

Sun Prairie – It’s illegal to ride a bike without your hands on the handlebars.

Look Ma! I’m breaking the law!

Wauwatosa – If a person fails to return books to the library, that person shall return their library card to the library until the books are returned.

You’ll get my library card when you pry it out of my cold, dead fingers. Come and get me librarians!

St. Croix – Women are not allowed to wear red in public.

Even Wisconsin Badgers red? Where’s your team spirit St Croix?

Wausau – Throwing snowballs, stones, arrows or other objects is illegal ($50 fine).

Stones and arrows I get. But snowballs? This is Wisconsin dammit! Let us have a little fun during winter.

Thursday, January 22, 2015

You’re Buying a House – Not Dating It

You’re Buying a House – Not Dating It

Buying a house based on emotions is just going to break your heart. If you fall in love with something, you might end up making some pretty bad financial decisions. There’s a big difference between your emotions and your instincts. Going with your instincts means that you recognize that you’re getting a great house for a good value. Going with your emotions is being obsessed with the paint color or the backyard. It’s an investment, so stay calm and be wise.

Lisa Bear of RE/MAX (262-893-5555) an experienced real estate agent in Wisconsin, Waukesha County & the entire Milwaukee Metro. Wisconsin Lake Living.

Buying a house based on emotions is just going to break your heart. If you fall in love with something, you might end up making some pretty bad financial decisions. There’s a big difference between your emotions and your instincts. Going with your instincts means that you recognize that you’re getting a great house for a good value. Going with your emotions is being obsessed with the paint color or the backyard. It’s an investment, so stay calm and be wise.

Lisa Bear of RE/MAX (262-893-5555) an experienced real estate agent in Wisconsin, Waukesha County & the entire Milwaukee Metro. Wisconsin Lake Living.

Wednesday, January 21, 2015

With Interest Rates and Home Prices on the rise, do you know the true Cost of Waiting?

With Interest Rates and Home Prices on the rise, do you know the true Cost of Waiting?

Today we are excited to have Morgan Tranquist as our guest blogger. Morgan is the Marketing & Graphics Director for The KCM Crew and provides insight into what the Millennial Generation needs to hear from their agents. – The KCM Crew

At Keeping Current Matters, we have often broken down the opportunity that exists now for Millennials who are willing and able to purchase a home NOW... Here are a couple other ways to look at the cost of waiting.

Let’s say you’re 30 and your dream house costs $250,000 today, at 4.12% your monthly Mortgage Payment with Interest would be $1,210.90.

But you’re busy, you like your apartment, moving is such a hassle...You decide to wait till the end of next year to buy and all of a sudden, you’re 31, that same house is $270,000, at 5.3%. Your new payment per month is $1,499.32.

The difference in payment is $288.42 PER MONTH!

That’s basically like taking a $10 bill and tossing it out the window EVERY DAY!Or you could look at it this way:

- That’s your morning coffee everyday on the way to work (average $2) with $11 left for lunch!

- There goes Friday Sushi Night! ($72 x 4)

- Stressed Out? How about 3 deep tissue massages with tip!

- Need a new car? You could get a brand new $20,000 car for $288.00 per month.

Had your eye on a vacation in the Caribbean? How about a 2-week trip through Europe? Or maybe your new house could really use a deck for entertaining. We could come up with 100’s of ways to spend $3,461, and we’re sure you could too!

Over the course of your 30 year loan, now at age 61, hopefully you are ready to retire soon, you would have spent an additional $103,831, all because when you were 30 you thought moving in 2014 was such a hassle or loved your apartment too much to leave yet.

Or maybe there wasn’t an agent out there who educated you on the true cost of waiting a year. Maybe they thought you wouldn’t be ready, but if they showed you that you could save $103,831, you’d at least listen to what they had to say.

They say hindsight is 20/20, we’d like to think that 30 years from now when you are 60, looking back, you would say to buy now…

Tuesday, January 20, 2015

Buying a Second Home Tips

Buying a Second Home Tips

Take your time when buying a second home. You already own one home and you should make sure you don’t rush through your research for your next home. Once you find a house at an affordable price, give yourself at least a 24-hour period to research it before committing any money towards it.Keep in mind if you’re investing in a second home that’s in another state, your title fees may vary, depending on the state.

Another issue with buying a second home is taxes. Your mortgage interest from a second home may or may not be tax-deductible. Consult with a tax professional or check out our Tax Calculator to see what you should be expecting if you purchase a second home. For some additional tax tips for second home owners from TurboTax, click here.

Lisa Bear of RE/MAX (262-893-5555) an experienced real estate agent in Wisconsin, Waukesha County & the entire Milwaukee Metro. Wisconsin Lake Living.

Monday, January 19, 2015

Don’t Try to Time the Market

Don’t Try to Time the Market

Don’t obsess with trying to time the market and figure out when is the best time to buy. Trying to anticipate the housing market is impossible. The best time to buy is when you find your perfect house and you can afford it. Real estate is cyclical, it goes up and it goes down and it goes back up again. So, if you try to wait for the perfect time, you’re probably going to miss out.

Don’t obsess with trying to time the market and figure out when is the best time to buy. Trying to anticipate the housing market is impossible. The best time to buy is when you find your perfect house and you can afford it. Real estate is cyclical, it goes up and it goes down and it goes back up again. So, if you try to wait for the perfect time, you’re probably going to miss out.

Sunday, January 18, 2015

When Character is More Valuable than Competence

When Character is More Valuable than Competence

Today we are pleased to have Nikki Buckelew back as our guest blogger. Nikki is considered a leading authority on seniors real estate and housing. Enjoy! - The KCM Crew

It was her 80th birthday and as Sue's family gathered around in celebration, she announced a major decision. After years of toying with the idea, she had come to the conclusion that now - yes, now - was the proper time for her to move into a continuing care retirement community (CCRC).Although they were a bit surprised, Sue's two adult children (both seniors themselves) nodded to each other and expressed relief that their mother would have access to the support and care she needed. Both admitted to a bit of worry about her living alone since their dad died, especially as they both traveled extensively and were not available to see her or care for her on a regular basis.

But, of course, they all realized that such a move would require a massive commitment of time and energy, with the first necessary step being to find a good real estate agent to help sell the longtime family home.

Sue mentioned that she was acquainted with an agent she had met at church and who regularly sent her mailings. The agent seemed quite nice and professional, had won numerous awards, was active in the community, and owned a variety of impressive-looking credentials. You know, she had a whole bunch of letters and acronyms at the end of her name.

Sue and her children arranged for a meeting with the agent, and while she was clearly competent and well-educated in her field, Sue just couldn't get past a nagging feeling that something was amiss. The agent was nice enough, but throughout Sue's entire life, she had tended to gravitate toward doing business only with those to whom she felt some sort of connection. Perhaps it was something she had learned from her father, a man who valued relationships in business dealings as much or more than mere competence. Not only did she want help, but she also wanted to feel a special sort of bond and trust.

The practice had served her well throughout life and now - with such an important transaction - she wasn't about to change her approach.

Sue scanned the yellow pages, spoke on the phone with a few agents, and even met with another over coffee, but still she couldn't find the sensation of trust and comfort she desired. She even did a couple of quick internet searches leaving her feeling confused and frustrated. It occurred to Sue's daughter that perhaps the CCRC that was to be Sue's new home would be able to provide a recommendation for a good agent. Indeed, they did, and that's when she met Joe.

Joe was different

He arrived at her home and immediately the two hit it off. Sue hired Joe to list and sell her house and as he began to take his leave, Sue touched him gently on the arm and said "Thank you, Joe. You are different than other agents I've met with," she smiled. "I don't know exactly what it is, but I feel I can truly trust you to help me make this move."Sue's home sold quickly, and with Joe's help, she arranged for an estate liquidator to sell the belongings she no longer needed. He also arranged for a moving company to pack and transport what was needed to Sue's new apartment at the retirement community, and made sure she was content in her new home.

A few days later, Sue's children visited their mother, breathed a sigh of relief that everything seemed under control, that a large project was complete and that - most importantly - Mom was happy, healthy, and safe. Her daughter (who admittedly had been a bit annoyed at Sue's "pickiness" in choosing an agent) smiled and remarked that Sue had made a fine decision in choosing Joe to spearhead the sale and move. "But Mom," Sue's son asked. "How did you make your decision? Why did you choose him?"

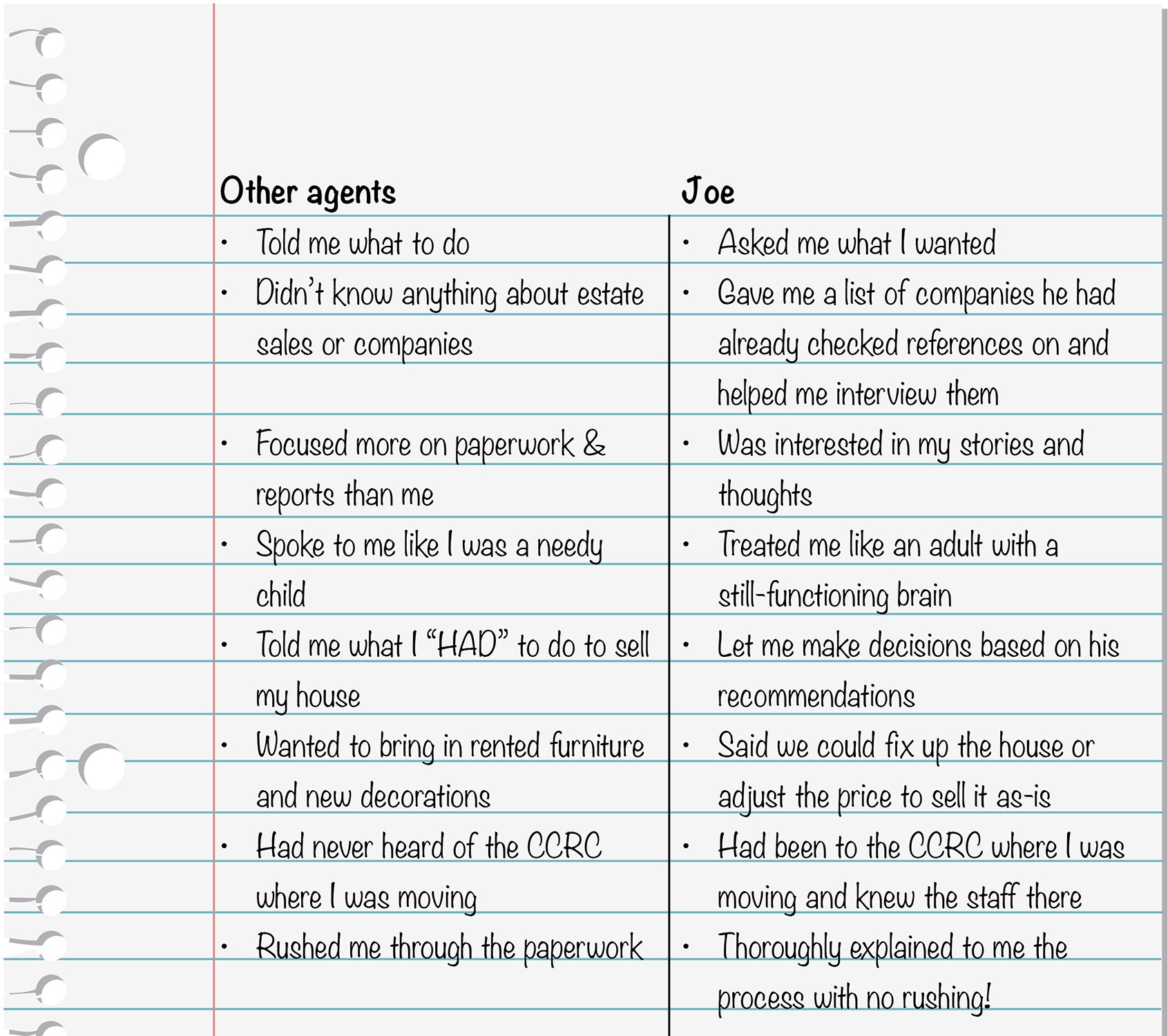

Sue dug into her purse and drew out the list of notes she had made while interviewing Joe:

As her daughters looked at the list, Sue remarked "I felt 'OK' with the other agents. They were undoubtedly good at their jobs. But I wanted someone who was good for ME too."

And thus ends the happy story of Sue, a senior whose outlook on doing business mirrors that of most of her generation, nearly all of whom value a firm handshake and "good vibes" as much as they do hard numbers and competency.

Bottom Line

As real estate professionals serving seniors, it's important that we understand that what makes for a great partnership, truly is in the eyes of our clients.Saturday, January 17, 2015

4 Sneaky Secrets to Raising Your Home Value

Most everyone knows that renovating bathrooms and kitchens sell homes. Gleaming floors and slabs of attractive granite top the list of what most homeowners want. However, do they rank high enough in terms of providing you the best ROI (return on investment)? - See more at: http://realtybiznews.com/4-sneaky-secrets-to-raising-your-home-value/98726970/#sthash.

Home remodeling experts offer a bit of insight on how much it costs for the average home renovation and how to boost home equity. Some upgrades are more obvious than others. But, what’s the one sneaky and unexpected upgrade that can give you the most bang for your buck? A new front door tops the list over a new kitchen as well as other obvious upgrades. Here are four sneaky ways to increase the overall value of your home.

1. Go Green If repairs and maintenance are on your home’s to-do list, put your money where it counts—go green. If your HVAC system is old and worn, invest in a new and more efficient model. Another green upgrade would be installing a new solar-powered water heater that will let you save as much as 85% on your utility bills.

2. New Windows Nobody wants to face the fact that they need new windows. But, many people are unaware of the huge impact it has on home value since it’s mostly a functional upgrade rather than a visual one. Amazingly though, spending around $10,000 on new windows can yield as much as 80 percent regarding ROI.

3. Install a Security System Having the ability to illustrate how key sensors protect the windows and doors along with how you use carbon monoxide sensors, smoke detectors, and flood warning systems generates a strong sense of security and safety for many prospective homebuyers and business owners alike. Therefore, these security features such as those from Arpel Security Systems will not only make your home or business much safer, but increase the value of it as well.

4. The Front Door A new front door is the number one sneaky way to improve your home and add value according to experts. On average, over 96 percent of what you spend on a new door adds value back into to the home. Keep in mind it has to be a quality door that suits the existing architecture of the home as well as aesthetically pleasing to the eye. Better yet, sometimes just repainting the front door in a different high-impact color and updating the hardware can have the same effect as buying a new one, in which case you would likely get a 100-percent-plus return on your investment.

These smart but sneaky upgrades are necessary in order to boost the potential equity in your home. This is especially true if you’re trying to get it market-ready. - See more at: http://realtybiznews.com/4-sneaky-secrets-to-raising-your-home-value/98726970/#sthash.RNgu2cHb.dpuf

Home remodeling experts offer a bit of insight on how much it costs for the average home renovation and how to boost home equity. Some upgrades are more obvious than others. But, what’s the one sneaky and unexpected upgrade that can give you the most bang for your buck? A new front door tops the list over a new kitchen as well as other obvious upgrades. Here are four sneaky ways to increase the overall value of your home.

1. Go Green If repairs and maintenance are on your home’s to-do list, put your money where it counts—go green. If your HVAC system is old and worn, invest in a new and more efficient model. Another green upgrade would be installing a new solar-powered water heater that will let you save as much as 85% on your utility bills.

2. New Windows Nobody wants to face the fact that they need new windows. But, many people are unaware of the huge impact it has on home value since it’s mostly a functional upgrade rather than a visual one. Amazingly though, spending around $10,000 on new windows can yield as much as 80 percent regarding ROI.

3. Install a Security System Having the ability to illustrate how key sensors protect the windows and doors along with how you use carbon monoxide sensors, smoke detectors, and flood warning systems generates a strong sense of security and safety for many prospective homebuyers and business owners alike. Therefore, these security features such as those from Arpel Security Systems will not only make your home or business much safer, but increase the value of it as well.

4. The Front Door A new front door is the number one sneaky way to improve your home and add value according to experts. On average, over 96 percent of what you spend on a new door adds value back into to the home. Keep in mind it has to be a quality door that suits the existing architecture of the home as well as aesthetically pleasing to the eye. Better yet, sometimes just repainting the front door in a different high-impact color and updating the hardware can have the same effect as buying a new one, in which case you would likely get a 100-percent-plus return on your investment.

These smart but sneaky upgrades are necessary in order to boost the potential equity in your home. This is especially true if you’re trying to get it market-ready. - See more at: http://realtybiznews.com/4-sneaky-secrets-to-raising-your-home-value/98726970/#sthash.RNgu2cHb.dpuf

Friday, January 16, 2015

Avoid Sleeper Costs

Avoid Sleeper Costs

The difference between renting and home ownership is the sleeper costs. Most people just focus on their mortgage payment, but they also need to be aware of the other expenses such as property taxes, utilities and homeowner-association dues. renting and home ownership also need to be prepared to pay for repairs, maintenance and potential property-tax increases. Make sure you budget for sleeper costs so you’ll be covered and won’t risk losing your house.

The difference between renting and home ownership is the sleeper costs. Most people just focus on their mortgage payment, but they also need to be aware of the other expenses such as property taxes, utilities and homeowner-association dues. renting and home ownership also need to be prepared to pay for repairs, maintenance and potential property-tax increases. Make sure you budget for sleeper costs so you’ll be covered and won’t risk losing your house.

Subscribe to:

Comments (Atom)